Streaming demolished that clarity. Billboard’s current system uses “album-equivalent units” where 1,500 song streams or 10 song downloads equal one album sale.

This means individual tracks gaining viral popularity can boost an album’s chart position even when nobody’s listening to the full project.The methodology creates bizarre outcomes.

In 2025’s year-end charts, only seven of the top 20 songs were actually released in 2025.

Sixteen came from 2024. Four songs that topped 2024’s charts also appeared in 2025’s top 10.

Teddy Swims’ “Lose Control” spent 112 weeks on the Hot 100, from August 2023 through October 2025. The song’s longevity broke records but also highlighted a problem: when massive hits dominate for multiple years, newer artists struggle to break through.

Taylor Swift monopolised the top 14 spots on the Hot 100 in May 2024. Historic? Absolutely. Representative of what most people were actually listening to? Debatable.

Charts now measure consumption patterns rather than cultural impact. They tell you what accumulated the most streams but miss the songs everyone’s actually talking about.

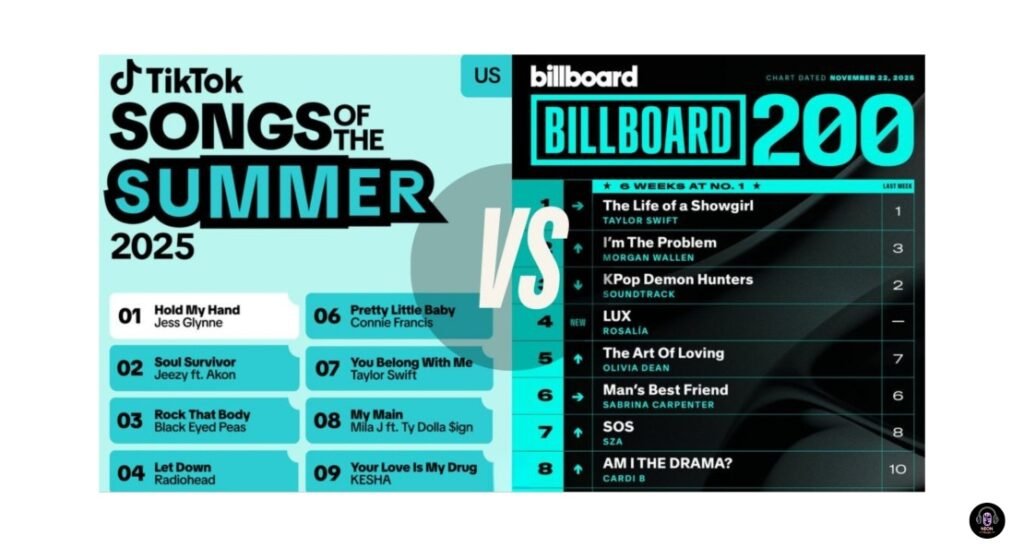

The TikTok Reality: How Music Actually Breaks Now

TikTok’s 2025 Music Impact Report drops numbers that make traditional metrics look quaint. The platform claims:

- 84% of songs entering Billboard Global 200 in 2024 went viral on TikTok first

- 10 of 11 UK number ones and 13 of 16 Billboard Hot 100 chart-toppers had major TikTok trends

- Over 3 billion tracks saved from TikTok to streaming services via “Add to Music App”

- 8 of 10 Billboard number ones in 2025 had viral TikTok moments first

Artists whose TikTok engagement correlates with streaming see an average 11% increase in on-demand plays within three days of a TikTok peak.

That’s the good news. Here’s the reality check.

MIDiA Research surveyed 10,000 global consumers in September 2025. Almost half (48%) didn’t stream music they heard on social media in the past month. Younger listeners aged 16-24 proved less likely than 25-34-year-olds to take almost every step through the discovery funnel after hearing a song on social media.

The paradox: 28% of 16-24-year-olds say their biggest barrier to streaming music from social media is hearing it “enough on social media” already. TikTok becomes an endpoint rather than a gateway.

Connie Francis’s “Pretty Little Baby” from 1962 topped TikTok’s global charts in 2025, generating over 600,000 daily video creations.

The song now has 130 million Spotify streams. Francis herself joined TikTok at 87 years old, calling it “overwhelming” that a 63-year-old recording captivated new audiences.

Blood Orange’s “Champagne Coast” from 2011 re-entered the UK Top 40 in 2024, 13 years after release. TikTok trends resurrected it. The streaming numbers exploded.

Traditional charts never accounted for this. A song can hibernate for over a decade, wake up to viral fame, and generate more streams than it did during its original release cycle.

Don’t miss the next big drop. Get weekly music breakdowns, exclusive content, and honest takes delivered straight to your inbox. Subscribe to the Neon Music newsletter. Plus, join the conversation with fellow music heads on r/neonmusic where we discuss everything from underground gems to mainstream moments.

Alternative Success Metrics That Actually Matter

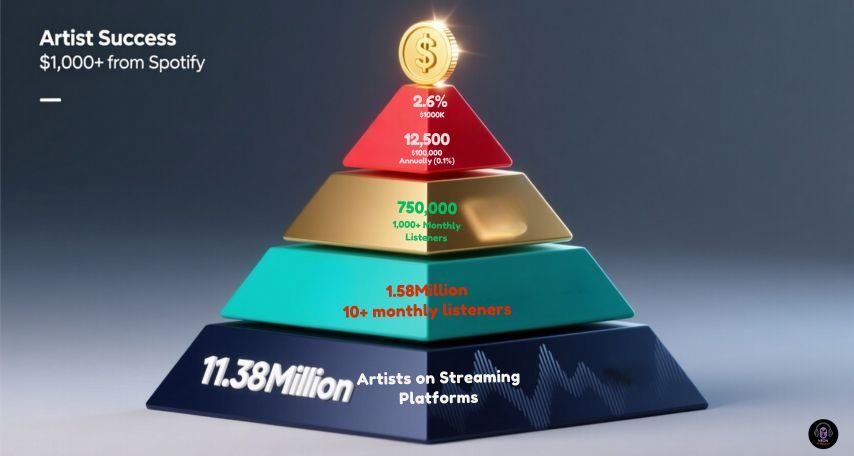

Chartmetric tracks 11.38 million artists in 2024, up 1.7 million from 2023. That’s 4,600 new artists joining daily.

But only 14% of Spotify profiles achieve more than 10 monthly listeners. Of that 14%, only 47% surpass 1,000 monthly listeners.

According to Spotify’s Loud & Clear data, just 2.6% of creators who’ve uploaded music earn more than $1,000 from the platform.

For artists seeking actual financial sustainability, chart positions matter less than these metrics:

Follower growth on streaming platforms

Spotify encourages artist marketing teams to focus on building followers rather than playlist placements. A follower represents intent. They chose to follow your work specifically, not just hear you on shuffle.

Recent data shows the number of artists generating between $1,000 and $10 million annually has tripled since 2017.

Nearly a quarter of the 12,500 artists generating over $100,000 in 2024 weren’t even releasing music professionally five years ago.

More tellingly: 80% of Spotify’s top-royalty generating artists weren’t featured in its Global Daily Top 50. Chart success and financial success have decoupled.

Conversion rates from discovery to streams

TikTok users are 68% more likely to pay for music subscriptions than average listeners. They spend 48% more time streaming music. Artists who maintain consistent TikTok presence see total streaming volumes climb 62% over time.

But virality doesn’t guarantee sustained listening. The gap between a viral moment and an actual career has never been wider.

Geographic distribution of streams

Artists with strong US and European audiences earn more per stream than those with listener bases in developing markets. Spotify’s streamshare model means your payout depends on where listeners live, not just how many you have.

Premium subscribers generate significantly higher payouts than ad-supported streams. Understanding your audience split matters more than total play counts.

Playlist placement sustainability

Over the past few years, prominent playlist placement was the priority over chart position. Then artists realised playlists don’t always acquire real fans.

You can rack up millions of passive streams from editorial playlists without building an audience that cares about your next release.

Algorithmic playlists like Discover Weekly reach 200 million users weekly. Each person gets a completely unique selection. The democratisation is real, but so is the competition.

Superfan identification and engagement

US music superfans are nearly twice as likely to be on TikTok (27% vs 14% of general population). These fans spend significantly on live music, physical albums, merchandise, and paid streaming services.

Recent industry analysis confirms superfans drive disproportionate revenue. Identifying and cultivating them matters more than chasing playlist adds or chart positions.

The AI Wildcard: When Charts Measure Code Instead of Creativity

The artist doesn’t exist. The vocals are synthetic. The entire production was AI-generated.

No late-night honky-tonk performances. No years honing craft in dive bars. No lived experiences to draw from. Just code.

Deezer now receives 50,000 fully AI-generated tracks every single day. That’s 34% of all daily uploads, up from 10,000 in January 2025.

Up to 70% of streams on AI-generated tracks are fraudulent, driven by bot networks gaming royalty payments.

Christian, rock, and emerging artist charts have all seen AI or AI-assisted acts appear in recent weeks. The phenomenon spans genres and shows no signs of slowing.

Michael Lewan, head of the Music Fights Fraud Alliance, warns that artificial streaming poses a bigger threat to music’s integrity than AI itself.

“A system that is not protecting organic engagement and authentic listenership will be more prone to attacks by people making a quick buck off of the royalty pool.”

When the next number one is created in code, who’s the author? When fans stream a song generated by an algorithm trained on copyrighted works without permission, who gets paid?

These aren’t hypothetical questions anymore. Breaking Rust already proved that AI can reach the top of the charts.

Traditional chart methodology has no mechanism to distinguish between human and synthetic artists.

You might also like:

- Streaming Payouts 2025: Which Platform Pays Artists the Most?

- How Streaming & TikTok Shape 2025’s Biggest Hits

- AI Songs Top Charts: Breaking Rust & the Rise of AI Slop

- How TikTok Viral Songs Dominated Charts in 2025

- The 2024 Music Industry Trends Guide: What’s Really Changing

- Spotify Streaming Chart Watch: December 2025 Rankings

What This Means For Your Career

Charts still matter for specific purposes. A chart placement opens doors. It’s a handy marketing tool that makes your music more visible to press, playlisters, promoters, new fans, sponsors, and potential collaborators.

Record labels still use chart positions to value songs as part of future transactions. Publishers care about chart performance. Radio programmers notice.

But as the primary marker of success? Charts lost that role years ago.

The fragmentation of consumption means no single metric captures the full picture. An artist can have millions of streams but struggle to sell 200 tickets. Another might chart modestly but sell out 5,000-capacity venues.

TikTok’s influence on discovery is undeniable, but virality doesn’t automatically translate to sustainable careers.

Chappell Roan started 2024 as a mid-level artist and rose to the top 1% of Chartmetric’s rankings through dedicated superfan engagement, not viral tricks.

Her approach shows what actually works: cultivating loyal audiences who care about the work, not just consuming content.

For independent artists, the democratisation is real. A teenager in their bedroom has the same shot at Discover Weekly placement as a major label artist with a million-pound budget. That’s simultaneously inspiring and terrifying.

Success in the streaming era doesn’t require a decade-spanning catalogue or a chart-topping hit.

The data proves musicians and niche genres can thrive in the new economy. But it requires understanding which metrics actually matter for your specific goals.

The Verdict: Charts Are One Tool Among Many

Music charts aren’t irrelevant. They’re just not sufficient.

If you’re an independent artist, obsessing over chart positions wastes energy better spent elsewhere. Focus on:

- Building genuine connections with superfans

- Understanding your streaming analytics (where listeners come from, which tracks convert casual listeners to followers)

- Creating consistent content across discovery platforms

- Diversifying revenue streams (streaming, live performance, merchandise, sync licensing)

- Monitoring follower growth on platforms that matter to your genre

If you’re already established with label support, chart positions still serve their traditional function. They validate success to industry gatekeepers, generate press coverage, and provide leverage in negotiations.

But even major artists can’t rely solely on charts anymore. The fragmentation of listening habits means hits develop differently now.

Some explode overnight through TikTok. Others build slowly through playlist placements. A few defy all patterns and succeed through paths nobody predicted.

The common thread isn’t a formula or template. It’s connection. Songs that make people feel something, share something, or return to something cut through the noise.

YouTube’s departure from Billboard won’t kill charts. It will force another evolution in methodology, just like streaming forced changes in 2014, 2018, and 2020.

Charts will adapt because the industry needs some shared measure of success, even if imperfect.

The real question isn’t whether charts matter. It’s whether you’re measuring the right things for your specific career goals.

Chart success might follow if you build sustainable audience relationships and create work people actually care about. Or it might not.

Either way, you’ll have built something that lasts longer than a week at number one.

That’s the future artists need to prepare for. Not the death of charts, but their relegation to one data point among dozens that collectively tell the story of a career.

The hits topping charts today reflect a complex ecosystem where TikTok virality, playlist algorithms, and traditional radio still compete for influence.

Some arrived through social media. Others grew steadily through algorithmic curation. A few defied expectations entirely.

None followed a formula because there isn’t one anymore. The industry keeps trying to reverse-engineer success, to find patterns that guarantee results.

But the most successful artists in 2025 share only this: they connected with people who cared enough to listen repeatedly.

Everything else is noise.